Specialty medications and injectables are saving lives-but they’re also breaking budgets. These drugs treat serious conditions like cancer, rheumatoid arthritis, MS, and hepatitis C. But they don’t come cheap. Many cost over $1,000 a month. For employers, that adds up to $34.50 per employee, per month-just for these drugs. And it’s only getting worse. Spending on specialty drugs is growing 10-12% a year, while regular prescriptions climb just 3-5%. If you’re paying for these through an employer plan, insurance, or even out of pocket, you’re feeling the pinch.

Start with Formulary Management

One of the most effective ways to cut costs is by managing which drugs are covered and under what conditions. This is called formulary management. It doesn’t mean denying care-it means making sure the right drug is used at the right time. Many plans use prior authorization to review prescriptions before approving them. For example, if a patient is prescribed a new GLP-1 weight loss drug, the system checks if they’ve tried cheaper, equally effective alternatives first. A study by Excellus BlueCross BlueShield found this approach saved $13.64 per member per month compared to national pharmacy benefit managers. That’s over $160 a year per person-without hurting outcomes. Step therapy is another tool. It means you try Drug A before moving to Drug B, even if your doctor prefers B. It sounds frustrating, but it works. In one case, a patient with rheumatoid arthritis was switched from a $12,000/month biologic to a $6,000/month generic alternative. Same results. Half the cost. The key? Make sure these rules are clinical, not just financial. If your plan uses formulary rules that feel arbitrary, ask for data. Ask: “What evidence supports this decision?”Use Narrow Pharmacy Networks

Not all pharmacies are created equal. Specialty drugs often require special handling-cold storage, trained staff, home delivery, ongoing monitoring. Most insurance plans let you choose any pharmacy. But that’s a mistake. When plans limit patients to a small group of specialty pharmacies, they get better prices. Why? Because those pharmacies agree to lower rates in exchange for volume. CarelonRx found that narrow networks cut costs by 10-15%. Children’s Hospital Association tracked a $1.3 billion drug spend over three years and saw 10% savings just by switching to a preferred network. Patients don’t always like it. Some don’t want to switch pharmacies. But the trade-off is worth it. In one study, 87% of patients using preferred networks said they got better support-faster refills, nurses calling to check in, help with side effects. Satisfaction scores jumped from 7.2 to 8.7 out of 10. If your plan doesn’t have a narrow network, ask why. Push for one. It’s not about limiting choice-it’s about getting better care at lower cost.Switch to Biosimilars When Possible

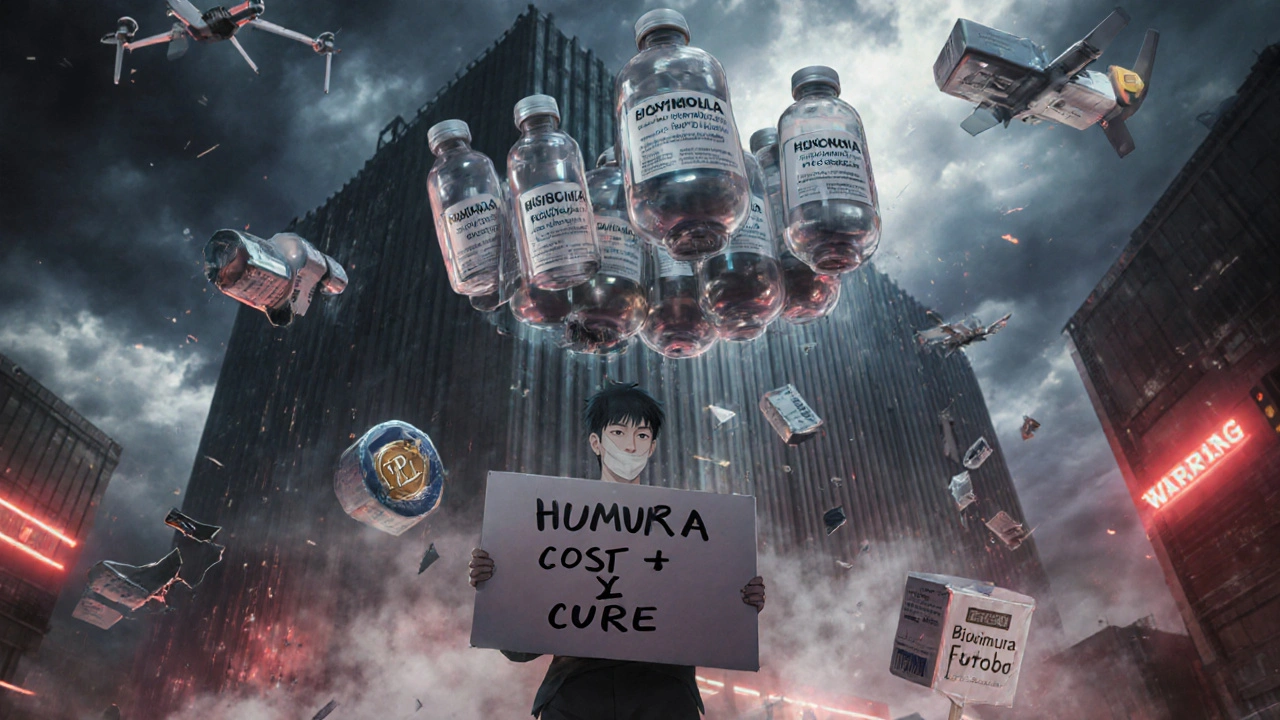

Biosimilars are the cheapest, most underused tool in the entire system. They’re not generics-they’re not exact copies. But they’re scientifically proven to work the same as the original biologic drug, often at half the price. Take Humira, for example. The brand version costs $7,000 a month. The biosimilar? Around $3,500. And it’s FDA-approved. The same goes for Enbrel, Remicade, Neulasta. There are now 42 FDA-approved biosimilars, but less than 30% of patients use them. Why? Fear. Doctors don’t always know how to prescribe them. Patients worry they’re “lesser.” But hospitals that switched to biosimilars saw 20-30% cost cuts-with no drop in effectiveness. One cancer center saved $1.2 million in one year just by switching one drug to its biosimilar. Ask your doctor: “Is there a biosimilar for this?” If they say no, ask why. If they say it’s not covered, ask your plan to change it. Biosimilars are safe. They’re cheaper. And they’re ready.

Move Injections Out of Hospitals

A lot of injectables are given in hospital outpatient departments. That’s expensive. Why? Because hospitals charge way more for the same service than a doctor’s office or even home care. Quantum Health studied 220 specialty drugs and found that 91% of them could be safely given outside the hospital. When patients switched to doctor’s offices or home infusion, costs dropped by 48%. That’s nearly half the price. For example, an infusion for multiple sclerosis might cost $1,800 in a hospital. In a clinic? $900. At home with a nurse? $700. Same drug. Same nurse. Same monitoring. Just a different location. Hospitals aren’t evil. They’re just set up to bill higher rates. But you don’t need their infrastructure for most infusions. Ask your care team: “Can this be done somewhere cheaper?” If they say no, ask for a second opinion. Many patients don’t know this is even an option.Use Financial Assistance Programs

Manufacturers often offer copay cards to help patients afford their drugs. But here’s the catch: those cards don’t count toward your deductible or out-of-pocket maximum. So you might pay $0 today, but still owe $7,000 later. That’s where copay maximizers come in. These are programs some plans use to redirect manufacturer assistance so it counts toward your out-of-pocket limit. That means you pay less now-and reach your cap faster. Once you hit it, the plan pays 100%. CarelonRx found that with copay maximizers, some patients went from paying $500/month to $0/month-and their employer paid less too. It’s a win-win. If your plan doesn’t have this, ask if they can add it. It’s not magic. It’s just smarter design.Push for Value-Based Contracts

What if the drug company only got paid if the drug worked? That’s value-based contracting. It’s not common yet-but it’s growing fast. Prime Therapeutics reported a 45% jump in these agreements last year. Here’s how it works: A drug costs $10,000 a month. But if the patient doesn’t improve after three months, the manufacturer refunds part-or all-of the cost. It aligns incentives. The drugmaker wants you to get better. So do you. It’s harder to set up. But for high-cost drugs like cancer treatments, it makes sense. Ask your employer or insurer: “Are we using value-based contracts for any specialty drugs?” If not, push for it. It’s the future.

Track the Numbers

You can’t manage what you don’t measure. If you’re an employer, ask for your plan’s specialty drug spending per member per month. If you’re a patient, ask your pharmacist: “How much does this cost? Is there a cheaper option?” Most people never ask. But the data is there. In 2023, 78% of large employers were already using at least three cost-reduction strategies. You don’t need to be a giant company to benefit. Look at your statements. Look at your copays. Look at your refill history. If you’re paying more than $500 a month for one drug, there’s probably a better way.What Doesn’t Work

Some ideas sound good but don’t deliver. Capping monthly out-of-pocket costs? That helps patients pay less-but doesn’t reduce overall spending. The drug still costs $10,000. Someone else pays it. Blaming patients for high prices? That backfires. People aren’t choosing expensive drugs. They’re prescribed them. Ignoring biosimilars? That’s just leaving money on the table. The real solution isn’t one trick. It’s a mix: better formularies, smarter networks, biosimilars, lower-cost settings, and contracts that tie payment to results.What’s Next?

The Inflation Reduction Act is starting to change things. Medicare is now negotiating drug prices. Experts say expanding that to private plans could save billions. The FDA is speeding up biosimilar approvals with Project BioSet. More options are coming. By 2026, experts predict shifting specialty drugs from medical benefits to pharmacy benefits could cut costs by 60-70%. That’s huge. The goal isn’t to cut care. It’s to cut waste. To make sure the money spent on these life-saving drugs actually leads to better health. You have more power than you think. Ask questions. Demand transparency. Push for better options. Your wallet-and your health-will thank you.Why are specialty medications so expensive?

Specialty medications are expensive because they’re complex to develop, often made from living cells (biologics), require special handling, and target rare or chronic conditions with small patient populations. Drugmakers recover R&D costs by pricing high, and without strong competition, prices stay elevated. Many also come with high administrative costs due to monitoring and support services.

Can I switch to a cheaper alternative without losing effectiveness?

Yes, in many cases. Biosimilars are proven to work the same as brand-name biologics. Step therapy can help you try lower-cost drugs first. For example, switching from a $12,000/month biologic to a $6,000/month alternative often gives identical results. Always talk to your doctor-but don’t assume the most expensive option is the best.

Do I have to use a specific pharmacy for my injectable?

Not always-but you should. Specialty pharmacies that are part of your plan’s narrow network offer lower prices and better support. They handle cold shipping, insurance paperwork, and nurse follow-ups. Switching might feel inconvenient, but it often saves money and improves care. Check your plan’s list of preferred pharmacies before filling your prescription.

Are biosimilars safe?

Yes. The FDA requires biosimilars to show no meaningful difference in safety, purity, or potency compared to the original drug. They undergo rigorous testing. Hospitals and cancer centers have been using them for years with no increase in side effects. If your doctor is hesitant, ask for the FDA approval data or ask for a second opinion.

Can I get my injection at home instead of the hospital?

For most injectables, yes. Over 90% of specialty infusions can be safely administered at home or in a doctor’s office. Home infusion is often 40-50% cheaper than hospital-based care. Ask your provider if your drug qualifies. Many plans cover home nursing services at no extra cost.

What should I ask my insurance plan about specialty drug costs?

Ask: Do you use a narrow specialty pharmacy network? Do you offer copay maximizers? Are biosimilars covered at lower tiers? Do you have prior authorization or step therapy rules? Are you using value-based contracts? If they can’t answer, ask for a written summary of your plan’s specialty drug strategy.

How long does it take to see savings from these strategies?

Some changes, like switching to a biosimilar or moving to home infusion, can save money immediately. Others, like negotiating new pharmacy contracts or implementing formulary rules, take 6-12 months to fully roll out. Most employers see a return on investment within 12-18 months.

Is there government help for specialty drug costs?

Yes. Medicare is now negotiating prices for some high-cost drugs. The Inflation Reduction Act also caps insulin at $35/month and out-of-pocket drug costs at $2,000/year for Medicare Part D. While these don’t cover all private plans, they’re setting a new standard. Some states are also creating assistance programs-check with your state health department.

Summer Joy

November 20, 2025 AT 17:51Aruna Urban Planner

November 22, 2025 AT 04:19Nicole Ziegler

November 22, 2025 AT 22:35Bharat Alasandi

November 23, 2025 AT 22:27Kristi Bennardo

November 25, 2025 AT 07:23Shiv Karan Singh

November 25, 2025 AT 21:39Ravi boy

November 27, 2025 AT 18:35Matthew Karrs

November 29, 2025 AT 00:31Matthew Peters

November 29, 2025 AT 07:12Liam Strachan

November 30, 2025 AT 07:49Gerald Cheruiyot

December 1, 2025 AT 01:56