Most people think a drug’s monopoly ends when its patent expires. But that’s rarely true. In reality, many top-selling drugs stay protected for years-sometimes over a decade-after their core patent runs out. This isn’t magic. It’s a system built into U.S. and EU drug laws called market exclusivity extensions. These aren’t patents. They’re regulatory tools, and they’re just as powerful, if not more so, at keeping generics off the market.

Why Patents Alone Don’t Control Drug Prices

A typical patent lasts 20 years from the date it’s filed. But for drugs, that clock starts ticking long before the product even hits shelves. By the time a drug gets FDA approval, it’s often already halfway through its patent life. That leaves maybe seven or eight years to make back the billions spent on research and trials. Without extra protection, companies would struggle to recoup costs. That’s where market exclusivity comes in. Unlike patents, which are granted by the USPTO, exclusivity is handed out by the FDA. It doesn’t depend on whether a drug is technically novel. It’s about incentives. The system was designed in 1984 under the Hatch-Waxman Act to balance innovation with access. But today, it’s been stretched far beyond its original intent.The Five Main Types of U.S. Regulatory Exclusivity

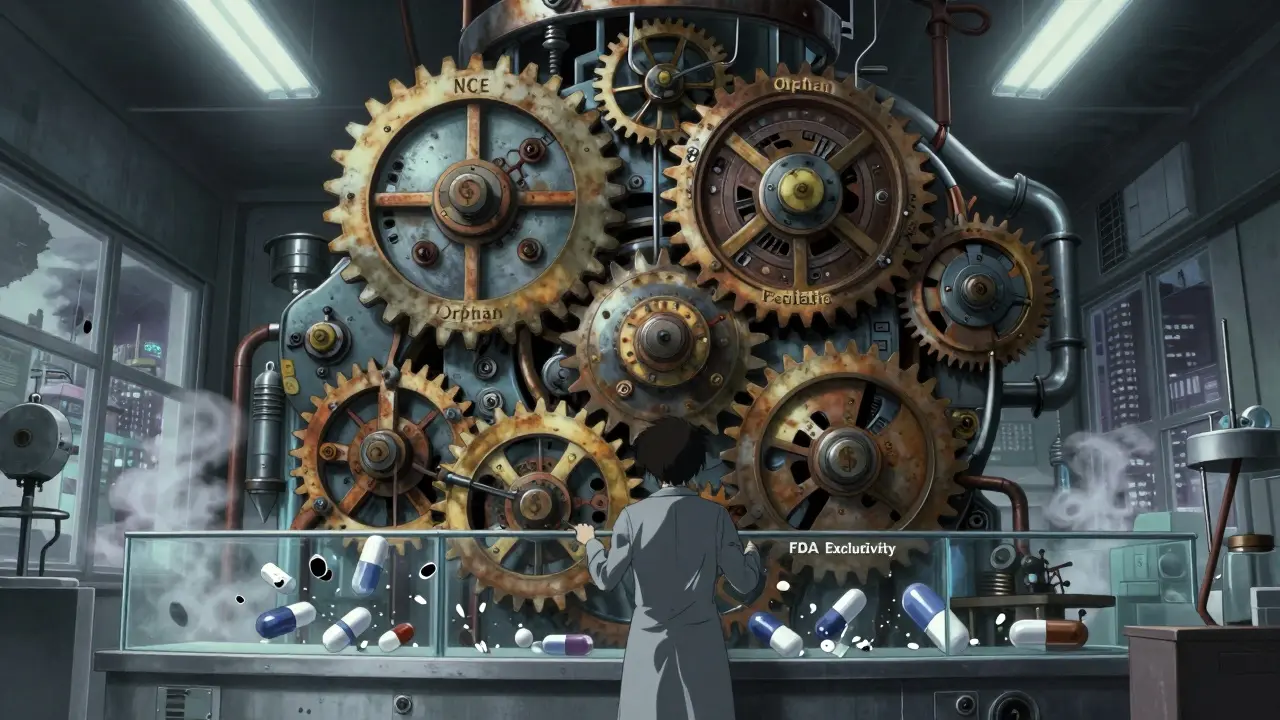

The FDA offers five key types of exclusivity that stack on top of patents. Each has its own rules, and companies play them like chess pieces.- New Chemical Entity (NCE) exclusivity: Five years of protection for a drug with an active ingredient never approved before. During the first three years, the FDA can’t even accept generic applications. For the full five, they can’t approve them.

- Orphan Drug exclusivity: Seven years for drugs treating conditions affecting fewer than 200,000 Americans. This one’s a big deal-nearly 40% of new drug approvals in 2022 were for orphan conditions.

- New Clinical Investigation exclusivity: Three years for a new use, new dosage, or new formulation of an existing drug. But here’s the catch: the new version must show real clinical benefit, not just a tweak.

- Pediatric exclusivity: Six extra months added to any existing exclusivity or patent. To get it, companies must complete FDA-requested pediatric studies. It’s not free-it costs time and money-but the payoff can be huge. One study found this extension added $1.2 billion in revenue for a single drug.

- Patent challenge exclusivity: 180 days of exclusive market access for the first generic company to successfully challenge a patent. This one’s meant to speed up generics, but it’s often used as leverage in negotiations.

What makes this system dangerous is stacking. A drug can have NCE exclusivity, then pediatric exclusivity, then orphan exclusivity, then three-year exclusivity for a new use-all at the same time. That’s how some drugs stay protected for 20+ years after approval.

How the EU Does It Differently

The European Union doesn’t use the same language, but the outcome is similar. Instead of multiple exclusivity types, they rely mostly on Supplemental Protection Certificates (SPCs). An SPC can extend market protection up to 15 years after drug approval, which is longer than the U.S. cap of 14 years.Europe also has orphan drug exclusivity-10 years, extendable to 12 if the company completes pediatric studies. That’s more generous than the U.S.’s seven years. But unlike the U.S., the EU doesn’t stack multiple exclusivities as easily. Instead, they combine SPCs with data exclusivity: eight years of data protection, plus two years of market exclusivity, plus one extra year if the drug meets certain innovation criteria.

Both regions offer incentives for pediatric research. But in the U.S., it’s a flat six-month bonus. In the EU, it’s baked into the SPC calculation. The result? The average drug in Europe gets about 13.5 years of post-approval protection. In the U.S., it’s 12.7-but rising fast.

The Patent Thicket Strategy

Companies don’t just rely on regulatory exclusivity. They file dozens of secondary patents on tiny changes: a new pill coating, a different dosing schedule, a slightly altered chemical form. These aren’t breakthroughs-they’re tweaks. But they work.Take tazarotene, a skin drug. Its core patent expired years ago. But the company filed 48 additional patents covering everything from packaging to delivery systems. Each one delayed generics. This is called a patent thicket. It’s not illegal. It’s just expensive and complex. Only big pharma can afford it.

Smaller companies can’t compete. That’s why 68% of biotech startups say market exclusivity extensions are critical to getting venture funding. Without them, investors won’t touch rare disease drugs-even if they save lives.

Product Hopping and the FTC’s Pushback

One of the dirtiest tricks in the playbook is product hopping. A company nears patent expiration and launches a slightly modified version of the drug-a pill instead of a liquid, or a once-daily instead of twice-daily. Then they stop making the original. Insurers and doctors are pressured to switch. Generics can’t enter because the old version is gone, and the new one is still protected.It’s not new. Teva reported in 2022 that this tactic delayed generic entry for 17% of their target drugs. But in 2023, the Federal Trade Commission stepped in. They filed an amicus brief arguing that product hopping violates antitrust laws. It’s the first major legal challenge to this practice. If courts side with the FTC, it could change how companies extend monopolies.

Who Benefits? Who Pays?

The system was meant to reward innovation. And in some cases, it does. Orphan drugs for rare diseases might never exist without exclusivity. The FDA approved 1,027 orphan drugs in 2022-up from 201 in 2010. That’s progress.But the cost is staggering. In 2022, branded drugs made up 78% of U.S. pharmaceutical spending-even though they accounted for only 10% of prescriptions. A 2023 JAMA study found that just four drugs-bimatoprost, celecoxib, glatiramer, and imatinib-cost the system an extra $3.5 billion over two years because of delayed generic entry.

And it’s getting worse. By 2028, the average drug will be protected for 16.3 years after approval, up from 12.7 in 2018. That’s nearly a decade longer than the original patent term. Experts like Dr. Peter Bach call it “evergreening.” Critics say it’s not innovation-it’s manipulation.

The Future: Tighter Rules, Bigger Battles

Regulators are starting to push back. In April 2023, the FDA tightened rules for three-year exclusivity, demanding stronger proof of clinical benefit. In September, the European Medicines Agency launched a pilot to speed up pediatric study reviews-making it easier to get the extra year of protection.But the game is still rigged. Companies have teams of 15 to 25 people just managing exclusivity. They start planning during Phase II trials, not after approval. They time patent filings to maximize protection. They exploit loopholes in pediatric requirements. And they win-every time.

For patients, it means higher prices. For insurers, it means higher premiums. For taxpayers, it means higher Medicare and Medicaid costs. For innovation, it’s a mixed bag. Some life-saving drugs exist because of these rules. Others? They’re just slightly changed versions of drugs that have been around for decades.

The question isn’t whether exclusivity should exist. It’s whether we’re still using it to encourage real breakthroughs-or just to delay competition for profit.

What’s the difference between a patent and market exclusivity?

A patent is a legal right granted by the patent office that protects the invention itself. Market exclusivity is a regulatory reward from the FDA that blocks generics from entering the market for a set time, regardless of patent status. You can have exclusivity without a patent, and vice versa.

Can a drug have multiple exclusivities at once?

Yes. A drug can have New Chemical Entity exclusivity (5 years), then get pediatric exclusivity (+6 months), then orphan exclusivity (7 years), and then three-year exclusivity for a new use. These can overlap, and the longest one usually controls. That’s how some drugs stay protected for 20+ years.

Why do orphan drugs get more exclusivity?

Developing drugs for rare diseases is expensive and risky because there are so few patients. The longer exclusivity (7 years in the U.S., 10 in the EU) is meant to make it financially viable. Without it, companies wouldn’t invest. That’s why nearly 40% of new drugs in 2022 were for rare conditions.

Does pediatric exclusivity really work?

Yes-but not always for kids. Companies often do the required pediatric studies just to get the six-month extension, even if the drug isn’t meant for children. The FDA now requires that studies be scientifically meaningful, not just a box to check. But the incentive is still strong: that six months can mean billions in extra revenue.

Are there efforts to stop these extensions?

Yes. The FTC is challenging product hopping. The FDA is tightening rules for new indication exclusivity. The EU is reviewing its SPC system. But big pharma spends billions lobbying to keep the system as is. Change is slow, but pressure is growing-especially as drug prices keep rising.

What Comes Next?

If you’re a patient, your best defense is awareness. Know when your drug’s exclusivity expires. Ask your pharmacist if a generic is coming. If you’re on a rare disease drug, thank the exclusivity system-but also ask if it’s truly necessary.If you’re in the industry, you’re already playing the game. The next move? Use exclusivity to build real innovation-not just legal barriers. The public is watching. And sooner or later, the system will have to answer for it.

Jaqueline santos bau

January 11, 2026 AT 15:42This is why my insulin costs $300 a vial-because some CEO’s kid got a BMW from the profits of this exact loophole. They’re not innovating-they’re just playing Monopoly with our health care system. And we’re the ones getting kicked off the board.

Kunal Majumder

January 13, 2026 AT 14:51Bro, in India we can’t even get generics sometimes because pharma companies lock down distribution chains. This whole system is rigged for the rich. The poor? They just wait and suffer.

Aurora Memo

January 14, 2026 AT 05:51I appreciate how you laid out the different types of exclusivity-it’s easy to think patents are the only barrier, but this breakdown makes it clear how layered the problem is. It’s not just greed; it’s a structural flaw baked into the law.

chandra tan

January 15, 2026 AT 22:39Same thing in India-we call it ‘evergreening’ but here it’s called ‘business smart.’ I mean, if you can extend a drug’s life by filing 48 patents on packaging? That’s not science. That’s legal engineering.

Dwayne Dickson

January 16, 2026 AT 00:28It’s a textbook case of regulatory capture. The FDA, ostensibly a public health agency, has become a de facto arm of pharmaceutical lobbying. The Hatch-Waxman Act was a compromise-now it’s a corporate welfare program masquerading as innovation policy.

anthony martinez

January 16, 2026 AT 12:48So let me get this straight-you’re telling me a company can patent the color of a pill and block generics? And we call this a free market?

Michael Marchio

January 16, 2026 AT 18:59Look, I get it-drug development is expensive. But when a company spends $10 billion on R&D and then turns around and spends $2 billion on lawyers to delay generics for another decade, that’s not innovation, that’s extortion. And the fact that we reward this with tax breaks and public funding? That’s not capitalism-it’s feudalism with a pharmacy logo.

neeraj maor

January 16, 2026 AT 23:56Did you know the FDA is secretly owned by Big Pharma? The SPCs? The pediatric bonuses? All designed to keep you dependent. The real cure? A global blackout on pharma patents. They’re not saving lives-they’re selling addiction. Wake up.

Paul Bear

January 17, 2026 AT 00:05While it is true that regulatory exclusivity mechanisms are intended to incentivize innovation, the empirical evidence demonstrates a significant misalignment between stated policy objectives and actual market outcomes. The phenomenon of product hopping, particularly in the context of antitrust jurisprudence, constitutes a prima facie violation of Section 2 of the Sherman Antitrust Act, as it artificially forecloses competitive entry without a legitimate procompetitive justification.

lisa Bajram

January 17, 2026 AT 19:46OMG, I just realized-my grandma’s glatiramer? That’s one of the $3.5B drugs?! That’s insane. And she’s on Medicare. I’m calling my rep tomorrow. This isn’t just a ‘pharma thing’-it’s a family emergency. We need to #BreakTheMonopoly!

Bradford Beardall

January 18, 2026 AT 01:04Wait, so if a drug gets orphan status AND pediatric exclusivity AND a new formulation, can it really get 20+ years? That’s longer than my college degree took. How is this legal?

McCarthy Halverson

January 19, 2026 AT 00:31Exclusivity isn’t the problem. Abuse is. Fix the loopholes, not the system.