If you’ve ever stared at a prescription receipt and wondered how you’ll pay for it, you’re not alone. In 2023, nearly 1 in 4 Americans skipped or cut back on meds because of cost. But there’s help-directly from the drug makers themselves. Prescription assistance programs run by pharmaceutical companies are one of the biggest, yet least talked about, ways people get life-saving drugs at low or no cost. These aren’t charity handouts. They’re structured programs with real rules, limits, and hidden traps. Knowing how they work can save you hundreds-or thousands-each year.

Two Types of Help: Copay Cards vs. Patient Assistance Programs

There are two main kinds of help from drug manufacturers. One is for people with insurance. The other is for those without it. They’re not the same. Mixing them up can cost you money-or even your coverage.Copay assistance programs (often called copay cards or coupons) are designed for people who have private health insurance. If your plan covers a brand-name drug but your copay is $150, the manufacturer might step in and cover $130. You pay $20. Sounds great, right? But here’s the catch: many insurance plans now use something called a copay accumulator. That means the manufacturer’s money doesn’t count toward your deductible or out-of-pocket maximum. So you’re still stuck paying your full deductible, even though you think you’re saving money. In 2023, 78% of major insurers used these programs, according to the National Academy for State Health Policy.

Patient Assistance Programs (PAPs) are for people who don’t have insurance-or have insurance that doesn’t cover their meds. These programs give you the drug for free or at a steep discount. To qualify, you usually need to prove your income is below 200-400% of the Federal Poverty Level. For a family of four in 2023, that meant earning less than $60,000 a year. Unlike copay cards, PAPs don’t require you to have insurance. But here’s another twist: if you’re on Medicare or Medicaid, you often can’t use them. That’s right. Some of the most vulnerable people are excluded by design.

Who Gets Help-and Who Doesn’t

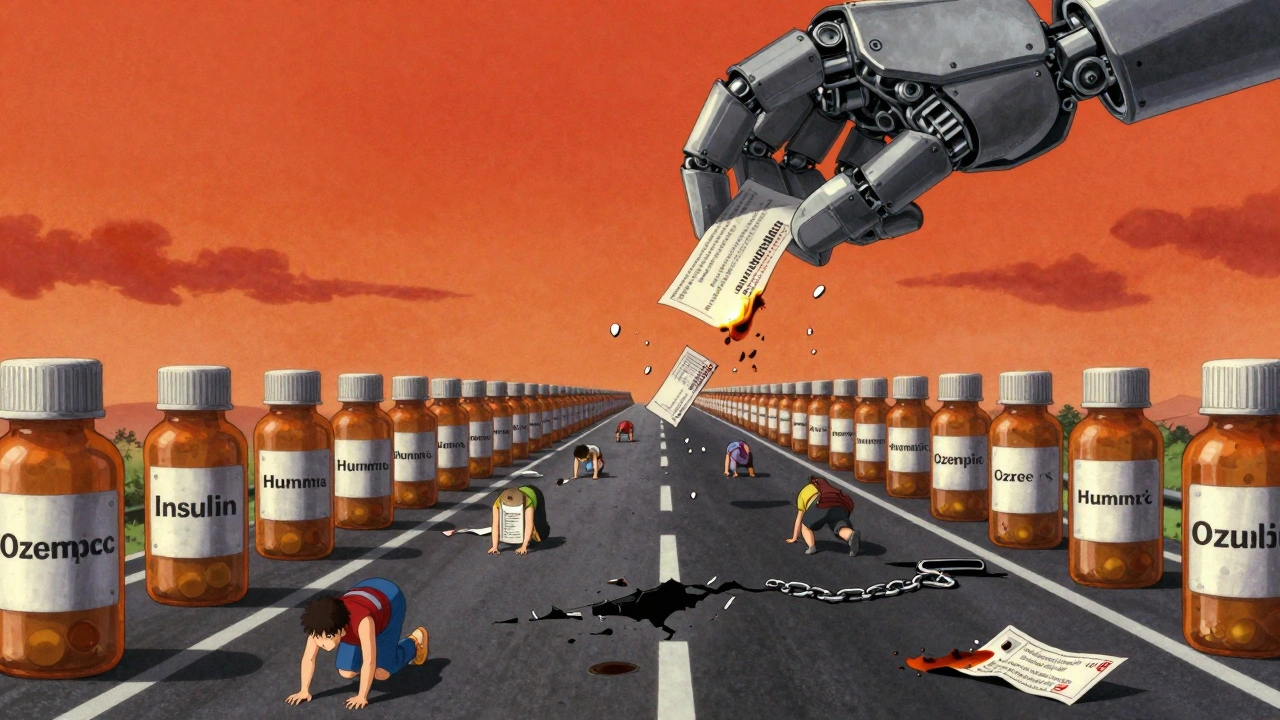

The rules aren’t fair. They’re not even consistent. One company might give you a free 90-day supply of your asthma inhaler. Another might say you’re ineligible because you have Medicaid-even if your income is $28,000 a year. The system is messy.According to the Pharmaceutical Research and Manufacturers of America (PhRMA), 92% of major drug makers offer some kind of patient assistance. In 2022, they spent $24.5 billion helping 12.7 million people. That’s a lot of lives touched. But the help isn’t evenly spread. Specialty drugs-like those for cancer, MS, or rheumatoid arthritis-make up 68% of all copay assistance programs. Meanwhile, common drugs like insulin or blood pressure pills often have fewer options.

And if you’re on Medicare? You’re in a gray zone. Copay assistance from manufacturers doesn’t count toward your Medicare Part D “true out-of-pocket” costs (TrOOP). That means even if you’re getting free drugs through a PAP, you’re still stuck in the coverage gap longer. You won’t hit catastrophic coverage any faster. That’s a big deal if you’re taking multiple expensive meds.

State laws add another layer. As of January 2024, 22 states have passed laws restricting how manufacturers can offer copay cards. California now requires drug companies to publicly report how much they spend on these programs. Other states ban them outright for Medicaid patients. Why? Because critics argue these programs push people toward pricier brand-name drugs instead of cheaper generics-even when the generic is just as effective.

How to Apply: It’s Not as Easy as It Sounds

You might think signing up is as simple as clicking a button. It’s not. PAP applications often take 45 to 60 minutes to complete. You need:- Proof of income (tax returns or pay stubs)

- Proof of residency (utility bill, lease)

- Doctor’s letter confirming medical need

- Your prescription details

- Insurance info (even if you’re denied coverage)

Some programs require you to reapply every year. Others auto-renew if your income hasn’t changed. The process is exhausting. A 2022 survey by the Patient Advocate Foundation found only 37% of eligible patients even knew these programs existed. That’s a huge gap.

For copay cards, it’s simpler. You can usually get one online in minutes. Just go to the drugmaker’s website, fill out a quick form, print or download the card, and bring it to the pharmacy. The pharmacist swipes it, and the discount kicks in automatically. Some cards cap savings at $100 per month. Others go as high as $25,000 a year-depending on the drug. Asthma and Allergy Foundation of America notes that for some inhalers, patients pay as little as $15 per prescription with a copay card, saving up to $90 per fill.

The Hidden Costs: Why Experts Are Split

Supporters say these programs are essential. Dr. Jane Smith of the Brookings Institution said in early 2024 that without copay assistance, 2.3 million more Americans would stop taking their meds. That’s not a small number. For people with chronic conditions, skipping a dose can mean hospitalization.But critics have hard data. A 2022 study in JAMA Internal Medicine found copay assistance programs increased total drug spending by $1.4 billion a year. Why? Because they make expensive brand-name drugs feel affordable-even when a generic exists. Insurance companies respond by raising prices, knowing manufacturers will cover the difference. It’s a cycle.

The National Institutes of Health (NIH) also points out a bigger problem: no one is tracking how well these programs actually work. There’s no central database. No official review. No accountability. If a company says it helped 100,000 people, there’s no independent way to verify it.

And then there’s the fairness question. These programs work best for people who already have insurance. People without coverage? They’re often excluded. Even if they qualify for a PAP, the paperwork is overwhelming. And if they’re on Medicaid? Many programs won’t touch them. That means the people who need help most are the least likely to get it.

How to Find the Right Program

You don’t have to figure this out alone. The Medicine Assistance Tool (MAT), run by PhRMA, is a free, confidential website that searches over 900 programs from hundreds of manufacturers. Just enter your drug name, income, and insurance status. It tells you what’s available.Here’s how to use it:

- Go to www.medicationassistancetool.org

- Enter your prescription name (you can search by brand or generic)

- Select your insurance status: private, Medicare, Medicaid, or none

- Enter your household income

- Click search

It will list all matching programs with links to apply. Some even let you download the application form directly. For copay cards, it gives you a printable version. For PAPs, it tells you exactly what documents you need.

Pro tip: Call your pharmacy. Many pharmacists know which programs are currently active and which ones are hard to get approved. They see this every day.

What to Do If You’re Denied

If you get turned down, don’t give up. Reasons for denial are often technical:- Income paperwork was dated

- Doctor’s letter didn’t include enough detail

- You accidentally checked the wrong insurance box

Call the program directly. Ask for a second review. Many will reconsider if you submit updated documents. Some programs have case managers who can help you fix errors.

Also, check if your drug has a nonprofit partner. Groups like the Patient Access Network Foundation or the HealthWell Foundation sometimes cover copays for people who don’t qualify for manufacturer programs.

The Bigger Picture: Is This the Answer?

These programs are lifesavers-for now. But they’re a patch on a broken system. Drug prices keep rising. Insurance plans keep changing. And while manufacturers spent $24.5 billion helping people in 2022, that’s still only a fraction of what’s needed. The Congressional Budget Office predicts that by 2028, these programs will serve over 15 million people and cost $34.8 billion a year.They’re not a solution to high drug prices. They’re a workaround. But if you’re struggling to afford your meds, a workaround is better than nothing. Use these programs. Know the rules. Apply early. And keep asking questions. Your health depends on it.

Iris Carmen

December 10, 2025 AT 01:24just applied for my insulin copay card and it took 47 minutes to fill out. like, i had to scan my pay stubs, get my doctor to sign a form, and then wait 3 days for a reply. meanwhile my bill keeps piling up. why is this so hard??

Katherine Rodgers

December 11, 2025 AT 05:07oh wow so the pharma companies are just *so* generous?? 💅 let me grab my tissue and cry about how they’re ‘helping’ while jacking up prices 200% every year. the real charity? not existing.

Lauren Dare

December 11, 2025 AT 17:50the structural inefficiencies here are staggering. copay accumulators effectively neuter the value proposition of manufacturer assistance, creating a perverse incentive for payers to exclude these subsidies from TrOOP calculations. it’s regulatory arbitrage disguised as consumer aid. and the Medicaid exclusion? a classic case of means-testing failure.

Gilbert Lacasandile

December 13, 2025 AT 09:47i’ve used the MAT tool and it actually worked for my RA med. didn’t know it existed till my pharmacist mentioned it. they’ve got a ton of programs hidden in plain sight. just gotta be persistent. maybe we need a national hotline or something?

Lola Bchoudi

December 14, 2025 AT 13:34if you’re on Medicare and struggling, don’t overlook nonprofit copay foundations-PAN, HealthWell, and the Chronic Disease Fund all have rolling applications. they’re not perfect, but they move faster than manufacturer programs. keep copies of everything, follow up every 72 hours, and if you get denied, ask for a case manager. they’re real people who want to help.

Morgan Tait

December 15, 2025 AT 03:02you know what they don’t tell you? these programs are just a Trojan horse. the drug companies use them to lock you into their brand-name drugs forever-no generics allowed. they bribe your doctor with samples, then use the copay cards to make you dependent. and the government? they’re in on it. it’s all part of the Pharma-Insurance-Pharmacist cartel. they want you addicted to overpriced pills. i’ve seen the documents.

Darcie Streeter-Oxland

December 16, 2025 AT 09:57It is, regrettably, a matter of considerable public concern that such a significant portion of pharmaceutical assistance remains opaque, administratively burdensome, and inconsistently regulated. One might posit that the absence of a centralized, federally mandated framework constitutes a systemic failure of public health policy.

Kathy Haverly

December 16, 2025 AT 18:07lol the ‘help’ is just a PR stunt. they spend $24.5 billion on this so they can keep charging $1,200 for a pill that costs $2 to make. and now they’re lobbying states to ban copay cards? classic. they’re not helping anyone-they’re just delaying the inevitable collapse of the system they created.