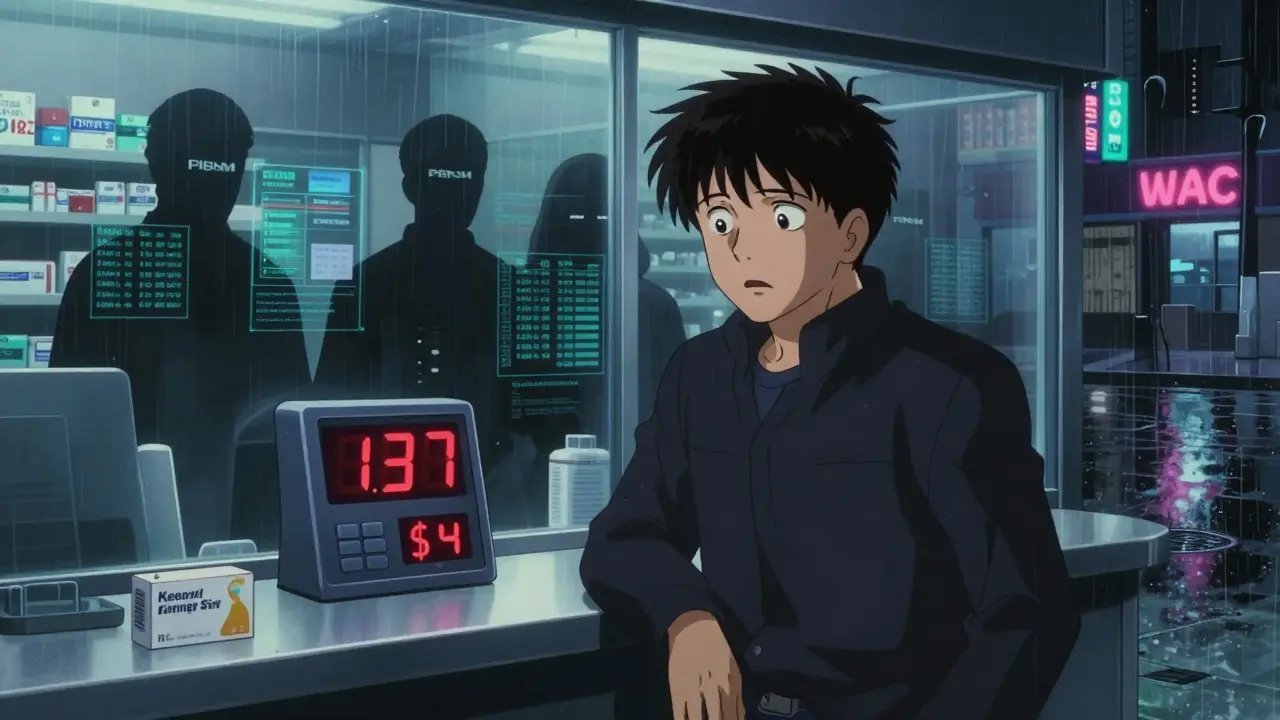

Ever filled a prescription and been shocked by the price at the pharmacy? You’re not alone. In 2025, Americans paid an average of $137 out-of-pocket for a 30-day supply of a generic medication - but the same drug cost just $9 at a different pharmacy down the street. The problem isn’t just high prices. It’s that price transparency is broken. Most patients have no idea what a drug should cost until they’re at the counter. That’s where tools designed to show real-time pricing come in - and they’re changing how people get their meds.

Why Generic Drug Prices Vary So Much

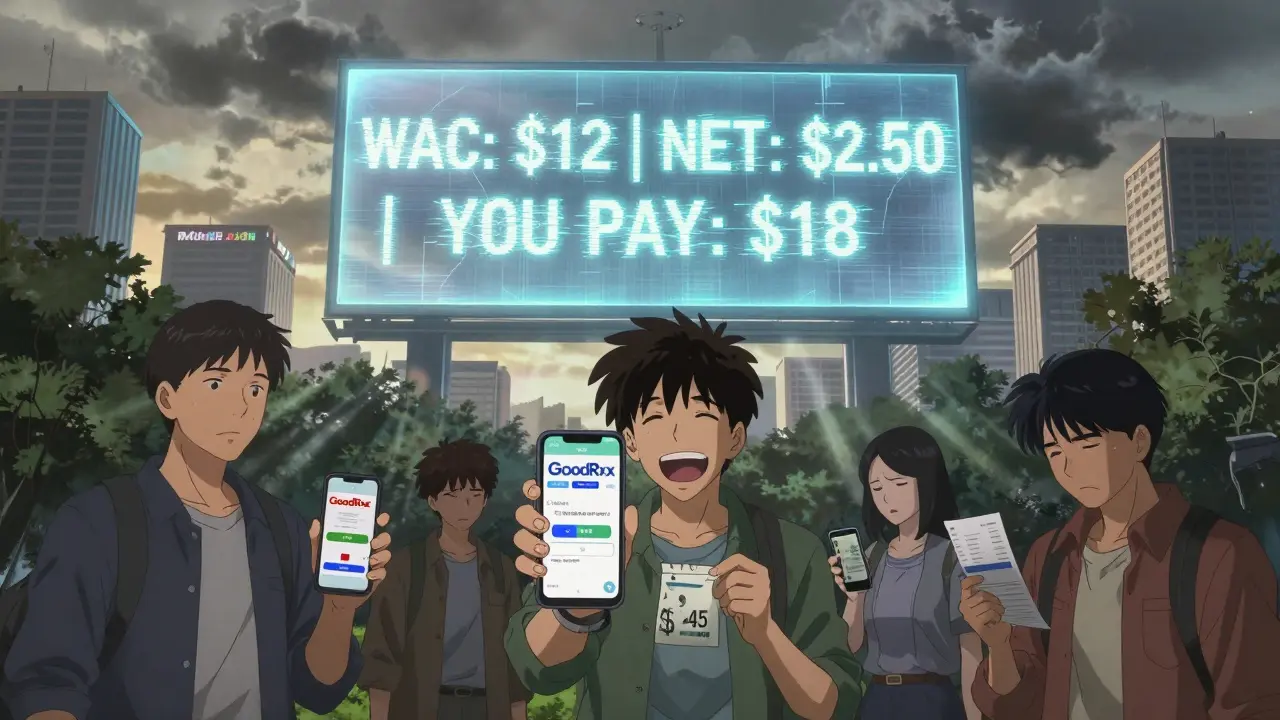

Generic drugs are supposed to be cheaper than brand-name versions. But in practice, the same generic pill can cost $3 at one pharmacy and $45 at another. Why? It’s not about the drug itself. It’s about the middlemen.The pharmaceutical supply chain is a maze. Manufacturers set a list price - called the Wholesale Acquisition Cost (WAC). But that’s not what pharmacies actually pay. Pharmacy Benefit Managers (PBMs), insurers, and pharmacies negotiate secret discounts and rebates behind closed doors. What you see on your bill is often a fraction of the WAC - or sometimes, even higher, depending on your insurance plan’s rules.

For example, a 30-day supply of metformin (a common diabetes drug) might have a WAC of $12. But after rebates, the net price could be $2.50. If your insurance plan doesn’t cover it well, you might still pay $18. Meanwhile, a cash-paying customer at a discount pharmacy might pay $4. No one knows these numbers unless they’re using a tool that pulls real-time data.

Real-Time Benefit Tools (RTBTs): What They Do

RTBTs are the most powerful tools for prescribers and patients who want to know the true cost before a prescription is written. These systems connect directly to your insurance plan through your doctor’s electronic health record (EHR). When your doctor types in a medication, the tool instantly shows you:

- Your exact copay or coinsurance

- Alternative generic options with lower costs

- Eligibility for patient assistance programs

Platforms like CoverMyMeds and Surescripts power these tools. As of early 2025, 42% of U.S. physician practices use RTBTs - up from just 15% in 2022. That’s because they work. One study found that when doctors used RTBTs, patients switched to lower-cost generics 8.2% more often. And in clinics that fully integrated the tool, patient out-of-pocket costs dropped by an average of 37%.

But RTBTs aren’t perfect. They need to be integrated into EHRs like Epic or Cerner. Setting it up takes weeks and costs around $12,500 per practice. And not all insurers feed accurate data into the system. If your plan doesn’t update its formulary in real time, the tool might show you a drug that’s no longer covered.

GoodRx and Other Consumer Apps

If you’re not seeing your doctor right now, you’re probably using GoodRx, SingleCare, or RxSaver. These apps let you search for the cheapest price on a generic drug near you. They pull data from thousands of pharmacies - CVS, Walgreens, Walmart, and even independent stores.

As of 2024, 43% of U.S. pharmacies accept GoodRx coupons. That means if you show the app at the counter, you can pay as little as $4 for a 30-day supply of lisinopril or amoxicillin. But here’s the catch: these discounts don’t always work.

A Trustpilot review from March 2025 had over 1,200 people complaining: “The app says $4, but when I get there, they say their system shows $15.” Why? Because GoodRx doesn’t always know your insurance status. If you’re on Medicare or Medicaid, the coupon might not apply. Or the pharmacy’s system might not have updated its pricing. It’s not fraud - it’s confusion.

Still, for cash-paying patients without insurance, these apps are lifesavers. A 2025 survey found that 61% of users saved more than $50 per month by using them. And some apps now offer free shipping or mail-order options, which can cut costs even further.

State Laws Are Changing the Game

By April 2025, 23 states had passed their own drug price transparency laws. And they’re not all the same.

- California requires drugmakers to report any price increase over 16% in two years.

- Minnesota created a Prescription Drug Affordability Board that can cap prices on certain high-cost generics.

- New York mandates that pharmacies disclose the cash price before you pay.

One Minnesota patient found a 92% price difference between two pharmacies for the same generic blood pressure pill. She saved $287 a year just by walking into the cheaper one. That’s the power of state-level transparency.

But these laws also have blind spots. They don’t force PBMs to reveal rebates. They don’t require manufacturers to show net prices. So while you can see the WAC or the cash price, you still can’t see the real cost behind the scenes - the one that insurers actually pay.

What’s Missing: The Rebate Black Box

The biggest problem with current tools? They don’t show net prices. The actual amount paid after rebates is hidden. PBMs argue that if net prices were public, it would hurt competition. But critics say it’s just a cover-up.

The 2020 Prescription Drug File rule was supposed to fix this. It required insurers to report how much they paid for drugs - including rebates. But implementation was delayed. As of early 2025, only a handful of states had fully enforced it.

And in March 2025, the federal government canceled the Medicare Two Dollar Drug List Model - a program that would have capped prices on certain generics for seniors. That was a major setback.

Without knowing net prices, patients and doctors are flying blind. A drug might look expensive on the shelf, but if your insurer got a $10 rebate, your copay should be $1. But you’ll never know unless your pharmacy or doctor has access to the real data.

How to Use These Tools Right

Here’s how to save money - no matter where you are in the system.

- If you’re seeing a doctor: Ask if they use an RTBT. If they don’t, request a printout of alternative generic options before the prescription is sent.

- If you’re paying cash: Open GoodRx or SingleCare before you leave the house. Compare prices at 3-4 nearby pharmacies. Don’t assume the closest one is cheapest.

- If you’re on insurance: Call your plan’s customer service. Ask: “What’s my copay for [drug name] at my local pharmacy?” Then ask: “What’s the cash price?” You might be surprised.

- For chronic meds: Check out RxAssist.org. It lists free or low-cost patient assistance programs from drugmakers. Over 1.2 million people used them in 2024.

One more tip: Always ask for a price before you pay. Pharmacies are required to give you a receipt showing the final cost. Use it to compare next time.

The Future of Price Transparency

The U.S. prescription drug transparency market is expected to hit $4.89 billion by 2029. That means more tools, better integration, and more pressure on PBMs to open up.

The Drug-price Transparency for Consumers Act of 2025 (S.229) could require drug ads to show the WAC price. That would make it harder for companies to hide costs. But it still wouldn’t show you the net price.

Experts agree: transparency alone won’t fix the system. The real issue is the rebate system - where discounts are hidden, and patients pay the price. Until that changes, tools will keep helping, but they won’t solve the core problem.

Still, for now, using the right tool can save you hundreds a year. Whether it’s your doctor’s RTBT, a pharmacy app, or a state portal - knowing your price before you pay is the first step to taking control.

Can I use GoodRx with my insurance?

GoodRx is designed for cash-paying patients. If you’re on insurance, the coupon won’t apply - and the pharmacy might not even accept it. In fact, using a GoodRx coupon with insurance can sometimes make your out-of-pocket cost higher. Always ask the pharmacist to check both your insurance price and the GoodRx price before you pay.

Why do pharmacies say the price is different than what the app shows?

Pharmacy pricing systems update slowly. The app might show a price based on last week’s data, but the pharmacy’s system hasn’t refreshed. Also, some pharmacies don’t participate in discount programs, or they’ve set their own prices higher. Always call ahead or ask the pharmacist to verify the price at the counter.

Do all generic drugs have price differences?

Yes - especially for older generics like metformin, lisinopril, or amoxicillin. These are produced by many manufacturers, and each pharmacy negotiates different deals. Newer generics or those made by only one company may have less variation. But even then, prices can differ by 200% between pharmacies.

Are patient assistance programs easy to get?

Not always. While programs like RxAssist help over a million people each year, 63% of users say the application process is overwhelming. You’ll need income verification, proof of insurance status, and sometimes a doctor’s signature. It takes time, but if you qualify, you can get drugs for free or at a steep discount.

Is there a federal law that forces drug companies to show prices?

Not yet. The Drug-price Transparency for Consumers Act (S.229) is pending in the Senate and would require drug ads to show the wholesale cost. But it doesn’t apply to pharmacies or patients. The 2020 Prescription Drug File rule requires insurers to report pricing, but enforcement is still limited. Right now, transparency is patchy - state by state, tool by tool.

Next Steps: What to Do Today

If you take a generic drug regularly:

- Open GoodRx or SingleCare and search for your medication.

- Call three local pharmacies and ask for their cash price.

- If you’re on insurance, call your plan and ask for your exact copay.

- Check RxAssist.org to see if your drug has a patient assistance program.

- Ask your doctor if they use a real-time benefit tool - and if not, request a price comparison sheet.

You don’t need to wait for a law to change. The tools are here. The data is there. You just need to use them.

John Sonnenberg

February 7, 2026 AT 12:59Pharmacies are playing a rigged game and everyone knows it. You walk in thinking you're getting a deal, then they hit you with $47 for metformin like it's gold-plated. No transparency means no accountability. This isn't healthcare-it's a lottery where the house always wins. I've had this happen three times this year. I'm done being a sucker.

And don't get me started on GoodRx. I used it for my dad's blood pressure med. Said $5. Pharmacy said $22. They didn't even apologize. Just shrugged. That's not customer service. That's theft with a smile.

Joshua Smith

February 7, 2026 AT 19:06This is actually one of the most well-researched pieces I've read on this topic. I didn't realize RTBTs were being adopted at 42% of practices now. That's a huge jump from 15% in 2022. I work in a small clinic and we just got integrated last month. The difference in patient satisfaction is night and day. People feel less anxious when they know the cost upfront. It’s not just about money-it’s about dignity.

Still, the rebate black box is the real villain here. If we could see what insurers actually pay, we’d understand why some drugs are priced so wildly differently. Maybe then we’d stop pretending this is a free market.

Elan Ricarte

February 8, 2026 AT 04:02Let’s cut the fluff. The entire pharmaceutical supply chain is a Ponzi scheme disguised as capitalism. PBMs are middlemen who don’t produce anything but still siphon off billions. They negotiate secret rebates, hide net prices, and then act shocked when patients can’t afford their meds. It’s not incompetence-it’s design.

And don’t give me that 'market forces' nonsense. There’s no market when pricing is opaque. You don’t negotiate when you’re handed a bill and told to pay or go without insulin. This isn’t a free market-it’s a hostage situation with a pharmacy receipt.

Meanwhile, Congress keeps passing laws that require ads to show WAC prices like that’s some kind of victory. WAC is the sticker price on a used car with rust. It’s meaningless. The real price-the net price-is what matters. And they won’t show it because if they did, the whole house of cards collapses.

So yeah. Use GoodRx. Call your insurer. Ask your doctor. But don’t fool yourself. None of this fixes the core rot. Until PBMs are regulated like utilities, we’re just rearranging deck chairs on the Titanic.

THANGAVEL PARASAKTHI

February 9, 2026 AT 20:33Hey man, i read this whole thing and i gotta say, this is some real important stuff. I live in india and we dont have this kind of problem really, generic drugs are super cheap here. Like $1 for metformin. But i know in usa its a mess. I think the problem is too many middlemen. In india, factory to pharmacy, no pmb or insurance middlemen. Simple.

Maybe usa should copy india model? Less bureaucracy, more direct. I know it sounds crazy but it works. Also, i used goodrx once and it worked great. Saved me like $60 on my friend's antibiotic. So its not all bad. Just need to fix the system. Thanks for the info!

Scott Conner

February 9, 2026 AT 23:10Wait, so if i’m on medicare, goodrx doesn’t work? I thought it was just a discount. I’ve been using it for my dad’s lisinopril and he’s been saving like $30 a month. Now i’m confused. Do i need to stop using it? Or is it just that some pharmacies don’t accept it? This is wild. I thought we were all on the same team here.

Also, what’s the deal with the 2020 rule being delayed? I feel like i’m reading a sci-fi novel where the government promises change but never delivers. Just… why?

Marie Fontaine

February 11, 2026 AT 06:32Tatiana Barbosa

February 12, 2026 AT 21:18As someone who works in public health policy, I’ve seen the impact of RTBTs firsthand. The 37% reduction in out-of-pocket costs isn’t a statistic-it’s a mother choosing between insulin and groceries. That number represents dignity.

But here’s what no one talks about: the emotional toll. Patients don’t just need lower prices-they need to feel like they’re not being exploited. When a pharmacist says, 'I’m sorry, our system says $18,' it’s not just a pricing error-it’s a betrayal. We need transparency not just for cost, but for trust.

And yes, patient assistance programs are a nightmare to navigate. We need to automate them. One form. One portal. One chance. Not 12 documents, three signatures, and a prayer.

Ken Cooper

February 13, 2026 AT 14:33I’m a pharmacist. I work at a small independent in Ohio. We get hit with pricing changes every single day. Sometimes the system updates, sometimes it doesn’t. GoodRx says $4, but our backend says $12 because the PBM just changed the tier. I don’t make the rules. I just try to explain it to people who are already stressed.

And yeah, we’ve got patients who come in with a printout from GoodRx and expect us to honor it. Sometimes we can. Sometimes we can’t. Sometimes we have to call the corporate office. It’s a mess.

But I’m not the villain. The system is. And I hate that I’m the one who has to break the bad news to someone who just needs their meds.

Ritteka Goyal

February 14, 2026 AT 03:10Why is america so bad at this? In india we have generic drugs for 10 rupees. 10 rupees! You can buy a whole month's supply for less than a cup of chai. Why does america have to make everything so complicated? Why do you need 10 middlemen? Why do you need apps and codes and insurance forms? Just make the price fair. Simple.

And don't even get me started on how you charge different prices for the same pill. In india, one price. One pharmacy. One system. No drama. No confusion. Just medicine.

I think america needs to learn from india. We don't have PBMs. We don't have rebates. We don't have 37 different apps. We just have doctors and pharmacies and patients. And it works. Maybe you should try it.

Jonah Mann

February 15, 2026 AT 15:59Biggest tip I’ve learned: always ask for the cash price before they swipe your card. I used to assume insurance was cheaper. Nope. For my azithromycin, cash was $7. Insurance was $23. I didn’t even know that was possible until I asked.

Also, don’t trust the app’s 'lowest price' without calling. I had a pharmacy tell me GoodRx was invalid because 'we don’t participate.' Then I walked 2 blocks and paid $3.50. That’s the power of persistence.

And if your doctor doesn’t use RTBT? Demand it. They’re not doing their job if they’re not helping you avoid overpaying.

Tricia O'Sullivan

February 17, 2026 AT 01:36While I appreciate the comprehensive overview, I must respectfully note that the structural inequities in pharmaceutical pricing are not merely logistical but deeply ethical. The commodification of essential therapeutics in a system predicated on profit maximization fundamentally undermines the principle of healthcare as a human right. One might argue that the proliferation of price-comparison tools, while beneficial, functions as a palliative rather than a curative intervention.

Until systemic reform-specifically, the elimination of rebate secrecy and the imposition of price controls on essential generics-is enacted, we are, in effect, asking patients to navigate a labyrinth designed to obscure rather than illuminate.

Lyle Whyatt

February 17, 2026 AT 23:22I used to think price transparency was just about saving a few bucks. Then my sister got diagnosed with lupus. She’s on 12 meds. Some of them? $300 a month. We used GoodRx. We called 12 pharmacies. We found one that had it for $42. That’s not a win. That’s a miracle.

But here’s the thing-no one told us this was possible. Not her doctor. Not the insurance rep. Not the pharmacist. We stumbled into it by accident. And that’s the problem. This shouldn’t be luck. It should be standard. Everyone should know this. Everyone should have this tool in their back pocket.

Why are we still treating life-saving drugs like luxury goods? Why do we have to be detectives just to afford our prescriptions? This isn’t healthcare. It’s a scavenger hunt with your life on the line.

MANI V

February 18, 2026 AT 04:30Of course prices are high. It’s because Americans are lazy and entitled. Why don’t you just take the generic? Why do you need the brand? Why do you think you deserve to pay less than $100 for a pill? In other countries, people work 12 hours a day just to afford basic medicine. You have GoodRx. You have state laws. You have options.

Stop whining. If you can’t afford it, you shouldn’t be taking it. That’s the truth. No one owes you a free pill. The system isn’t broken. You are.

Susan Kwan

February 18, 2026 AT 10:51Wow. 42% of doctors use RTBTs? That’s a 27% increase in three years. And you’re calling that progress? We’re talking about people’s lives here. We’re talking about diabetics choosing between insulin and rent. And you think 42% is a win?

Meanwhile, the federal government canceled the Two Dollar Drug List Model. The one that would’ve capped prices for seniors. That’s not policy. That’s cruelty dressed up as budgeting.

Let me guess-the next thing you’ll say is 'just use GoodRx.' Right? Like that’s a solution and not a Band-Aid on a severed artery.

Random Guy

February 20, 2026 AT 04:13GoodRx says $4. Pharmacy says $15. I asked why. They said 'system glitch.' I said 'cool, I'll just go to CVS.' They said 'they're $18.' I said 'I'm going home.' Then I called my doctor and asked for a different med. They gave me one. It cost $2.50 cash.

So yeah. The system is broken. But you? You can still win. Just don't trust anyone. Not the app. Not the pharmacist. Not your insurance. Trust your own damn legs and your own damn phone.

John Sonnenberg

February 21, 2026 AT 13:35My neighbor’s kid has asthma. She’s on albuterol. The cash price? $45. With GoodRx? $22. With insurance? $78. She’s 12. Her mom works two jobs. She chose the $22 option. That’s not saving money. That’s survival.

And the pharmacy? They didn’t even tell her about GoodRx. They just said 'that’s your copay.'

That’s not a glitch. That’s negligence. And it’s happening every damn day.