When you fill a prescription for a generic drug, you might think you’re getting the cheapest option. But what if your insurance plan is actually paying more than it needs to? The truth is, bulk buying and tendering is how insurers save millions on generic medications-often without you knowing it.

What Bulk Buying and Tendering Actually Means

Bulk buying means insurers and pharmacy benefit managers (PBMs) buy huge amounts of generic drugs at once. Tendering is when they open bids to multiple manufacturers and pick the lowest price. It’s not just about buying in bulk-it’s about forcing competition. Think of it like a reverse auction: instead of sellers bidding up the price, manufacturers bid down to win the contract.

This system started in the 1980s after the Hatch-Waxman Act made it easier for companies to make generic versions of brand-name drugs. Back then, generics were rare. Now, they make up over 90% of all prescriptions in the U.S. But here’s the twist: even though generics cost far less to produce, many insurance plans still pay too much for them.

How Savings Happen-And Why They’re Not Always Passed Along

When a new generic drug hits the market, prices can drop 80-90% within a year. For example, when the first generic version of the heart drug lacosamide arrived, it saved patients and insurers over $1 billion in the first 12 months. The same happened with pemetrexed and bortezomib. These aren’t outliers-they’re the rule.

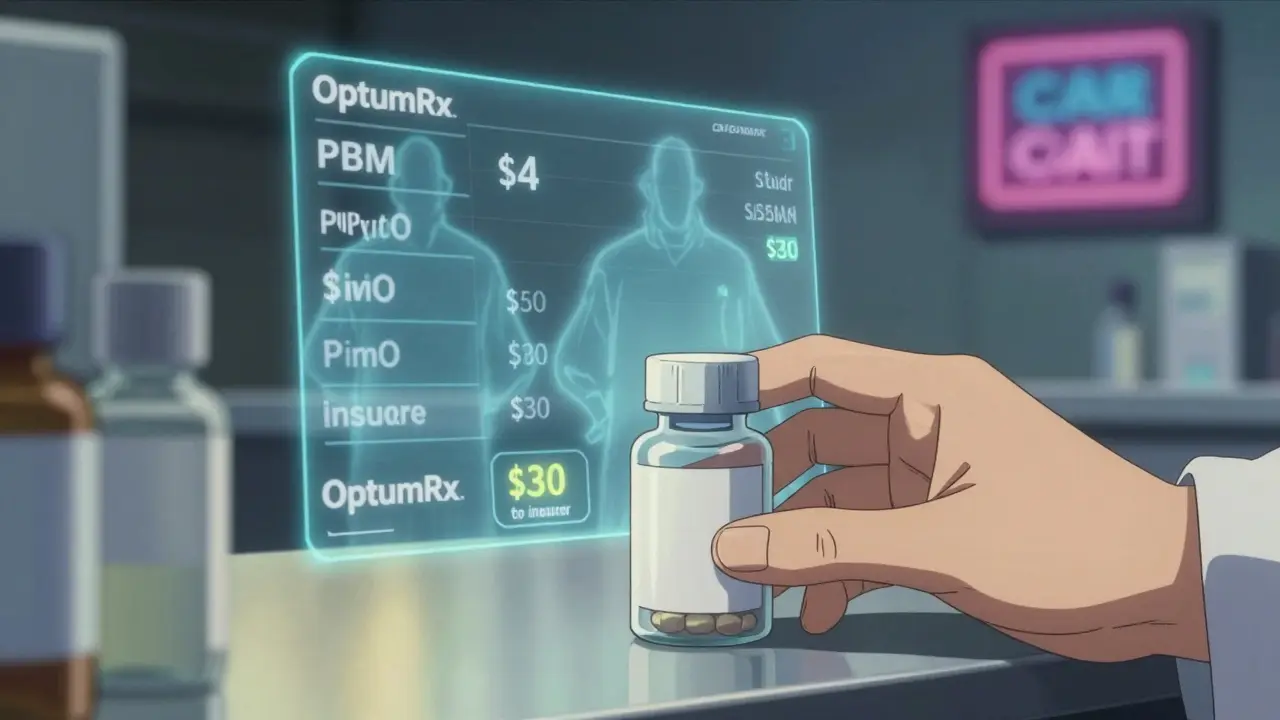

But here’s where things get messy. PBMs like OptumRx, Caremark, and Express Scripts don’t always pass those savings on. Many use something called “spread pricing.” That means they tell your insurer they paid $10 for a pill, but they actually paid $4. The $6 difference? That’s their profit. You don’t see it. Your copay stays the same. And your insurer thinks they’re saving money-when really, they’re just paying more than they need to.

A 2022 study in JAMA Network Open found that some generic drugs on insurance formularies cost more than cheaper alternatives with the same active ingredient. Why? Because those high-cost generics give PBMs bigger spreads. The system rewards complexity, not savings.

What Insurers Do to Fix This

Smart insurers are fighting back. They’re using Maximum Allowable Cost (MAC) lists-hidden price caps that tell pharmacies the most they’ll pay for a generic. But here’s the problem: those lists aren’t shared with plan sponsors. So even if your insurer is paying $25 for a pill, they don’t know the MAC is $8.

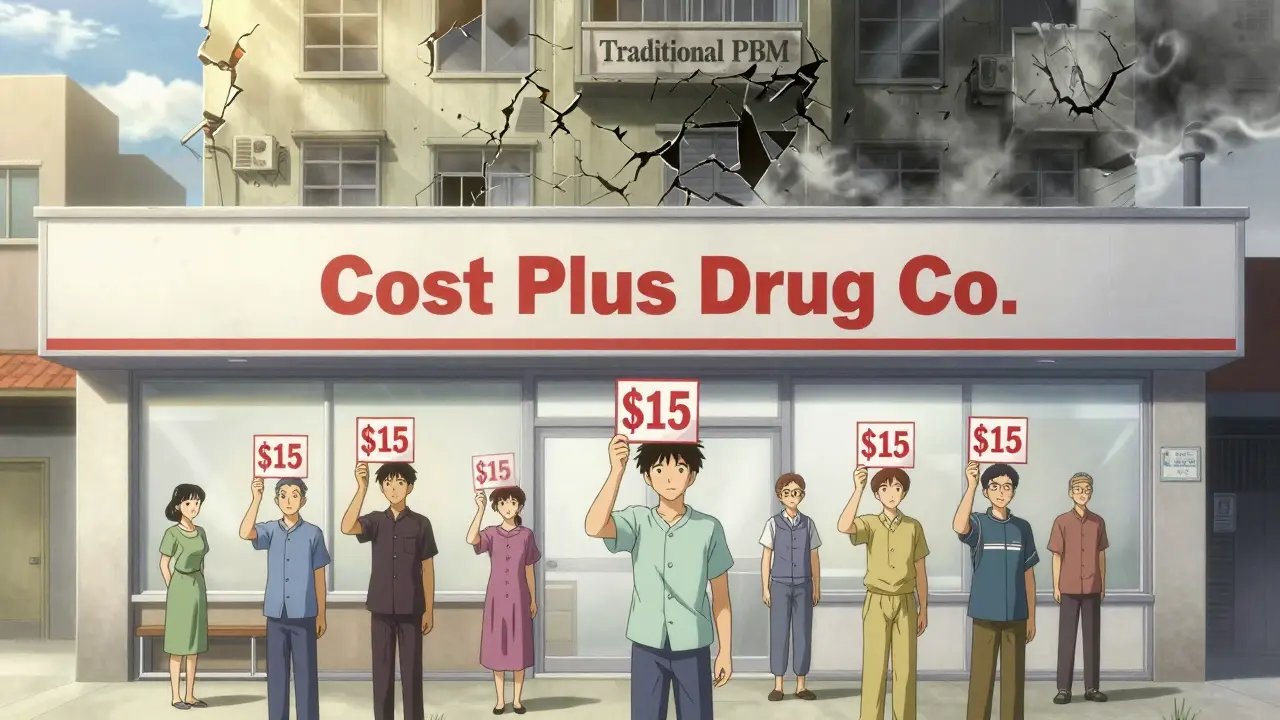

To fix that, some are switching to transparent models. Costco and Mark Cuban’s Cost Plus Drug Company cut out the middleman entirely. They buy directly from manufacturers, add a fixed 15% markup, and sell to consumers. The result? A blood pressure pill that costs $45 at your local pharmacy might be $15 at Cost Plus. No insurance needed.

One Blueberry Pharmacy user summed it up: “My medication costs exactly $15/month. No surprises.” That’s the kind of predictability insurers want-but can’t always get from traditional PBMs.

Why Some Generics Are Still Overpriced

Not all generics are created equal. Some have only one or two manufacturers making them. When competition is low, prices don’t drop. The FDA found that 80% of certain generic drugs are made by just three companies. That’s not a market-it’s a cartel waiting to happen.

And when prices get too low, manufacturers quit. In 2020, albuterol inhalers disappeared from shelves because no one could make them profitably at the prices PBMs demanded. Hospitals reported shortages at 87% of facilities. So while squeezing prices saves money now, it can cause shortages later.

That’s why the best insurers don’t just chase the lowest bid. They look at reliability, manufacturer history, and supply chain stability. A slightly higher price from a trusted supplier is better than a $2 drug that’s out of stock every other month.

What You Can Do-Even If You’re Not an Insurer

You don’t need to be a big company to save on generics. If your insurance copay is $30 for a pill that costs $5 cash at Walmart, you’re paying too much. Use GoodRx or SingleCare. Pay cash. Skip the insurance.

A 2023 survey found that 97% of cash payments for prescriptions were for generics. Why? Because people figured out that insurance doesn’t always help. In fact, Medicare beneficiaries who skipped doses to make pills last longer? 41% of them. That’s not frugality-it’s a broken system.

And here’s the kicker: you don’t need a prescription discount card. Just ask the pharmacist. Many pharmacies will give you the cash price without you even asking. If they say “I don’t know,” ask for the manager. The cash price is often lower than your insurance copay-especially for generics.

The Bigger Picture: Who’s Really Saving?

In 2023, generics saved the U.S. healthcare system $445 billion. $194 billion of that went to adults aged 40-64. That’s not a drop in the bucket. That’s money kept in people’s pockets, not paid to middlemen.

But the savings aren’t evenly distributed. The biggest winners are the insurers and PBMs who control the contracts. The biggest losers? Patients who don’t know they can pay less.

Regulators are starting to catch on. The Inflation Reduction Act of 2022 didn’t fix the problem-it just added more rules. But in January 2024, Medicare forced PBMs to disclose pricing details. That’s a start.

Meanwhile, companies like Navitus Health Solutions are showing that better procurement can cut generic costs by 22% for employers. That’s not magic. It’s just doing the math and demanding transparency.

What’s Next?

The future of generic drug pricing isn’t about more regulation. It’s about more clarity. Insurers who demand to see the real cost of every generic-down to the manufacturer, the bid, and the spread-are the ones who’ll save the most.

For patients, the message is simple: don’t assume insurance is helping. Check the cash price. Use discount tools. Ask questions. The system is rigged to hide savings. But the savings are still there-if you know where to look.

And if you’re part of an employer plan? Push for transparent PBM contracts. Demand disclosure of spread pricing. California did it with Senate Bill 17 in 2017. Other states can too. Because when insurers stop playing games with generic drug pricing, everyone wins.

Shawn Raja

January 26, 2026 AT 11:22So let me get this straight - we’ve got a system where the cheapest drugs in the world are being marked up like designer handbags, and the people who need them most are the ones getting screwed? And the middlemen? They’re sipping champagne on a yacht made of pill bottles. I’m not mad, I’m just disappointed. This isn’t capitalism - it’s a hostage situation with a pharmacy counter.

Ryan W

January 26, 2026 AT 12:55MAC lists are a band-aid. The real issue is the FDA’s failure to enforce competitive manufacturing standards. With only three producers for 80% of generics, we’re not dealing with a market - we’re dealing with an oligopoly protected by regulatory capture. The Inflation Reduction Act was performative. What we need is antitrust enforcement on PBM contracts - not more transparency theater. The system is structurally corrupt.

Allie Lehto

January 26, 2026 AT 23:44my heart just broke reading this 😭 like... how are we still letting this happen? people are skipping doses to make pills last??? that’s not frugal, that’s trauma. i just filled my script for $12 and cried because i know someone out there is paying $45 for the same thing. we need to fix this. like, NOW. 💔

TONY ADAMS

January 27, 2026 AT 04:32bro just pay cash. i got my adderall for $8 at walmart. insurance wanted $35. i didn’t even ask. just walked up and said "cash price." they gave it to me. no card. no app. no drama. why are we still playing this game?

Napoleon Huere

January 27, 2026 AT 12:31There’s a deeper existential question here: if a drug saves your life, but the system makes you beg for its price - is it really a medicine, or just a commodity disguised as care? We’ve turned survival into a negotiation. And the people who need it most are the worst negotiators. That’s not healthcare. That’s capitalism with a stethoscope.

Shweta Deshpande

January 27, 2026 AT 18:24Oh my goodness, this is so important!! I live in India and we have amazing access to cheap generics - like, $1 for a month’s supply of metformin - but I never realized how broken the system is in the US. It breaks my heart. People in America are suffering because of paperwork and profit margins?? We need to share these stories more. Maybe if more people knew, change would happen faster. ❤️

Aishah Bango

January 29, 2026 AT 11:04It’s not just about money. It’s about dignity. When you have to choose between food and your blood pressure meds, you’re not being frugal - you’re being punished for being sick. And the people who profit from this? They sleep just fine. That’s the real crime.

Simran Kaur

January 31, 2026 AT 00:32I just cried reading this. I remember when my mom couldn’t afford her insulin - she’d split pills in half and pray it was enough. We didn’t talk about it. We just suffered quietly. This system doesn’t just cost money - it steals peace. Thank you for writing this. Maybe now someone will listen.

Neil Thorogood

February 2, 2026 AT 00:17Just paid $4.50 for my antidepressant at Costco. Insurance would’ve charged me $42. 😤 I’m not even mad - I’m just… done. If you’re still using insurance for generics, you’re doing it wrong. Go to GoodRx. Ask the pharmacist. Walk out with your dignity - and your wallet - intact. 💪💊

Jessica Knuteson

February 2, 2026 AT 16:11