By 2025, if you’re on Medicare and take generic drugs, your out-of-pocket costs could drop by hundreds of dollars a year-sometimes to zero. It’s not magic. It’s the result of major changes to Medicare Part D that finally made generic medications more affordable for millions of seniors. But understanding how it works isn’t easy. The rules changed, the caps shifted, and now your copays depend on things like whether you’re in a stand-alone plan or a Medicare Advantage plan, and whether you’ve hit your out-of-pocket limit. This isn’t about theory. It’s about what’s in your wallet right now.

What Changed in Medicare Part D in 2025?

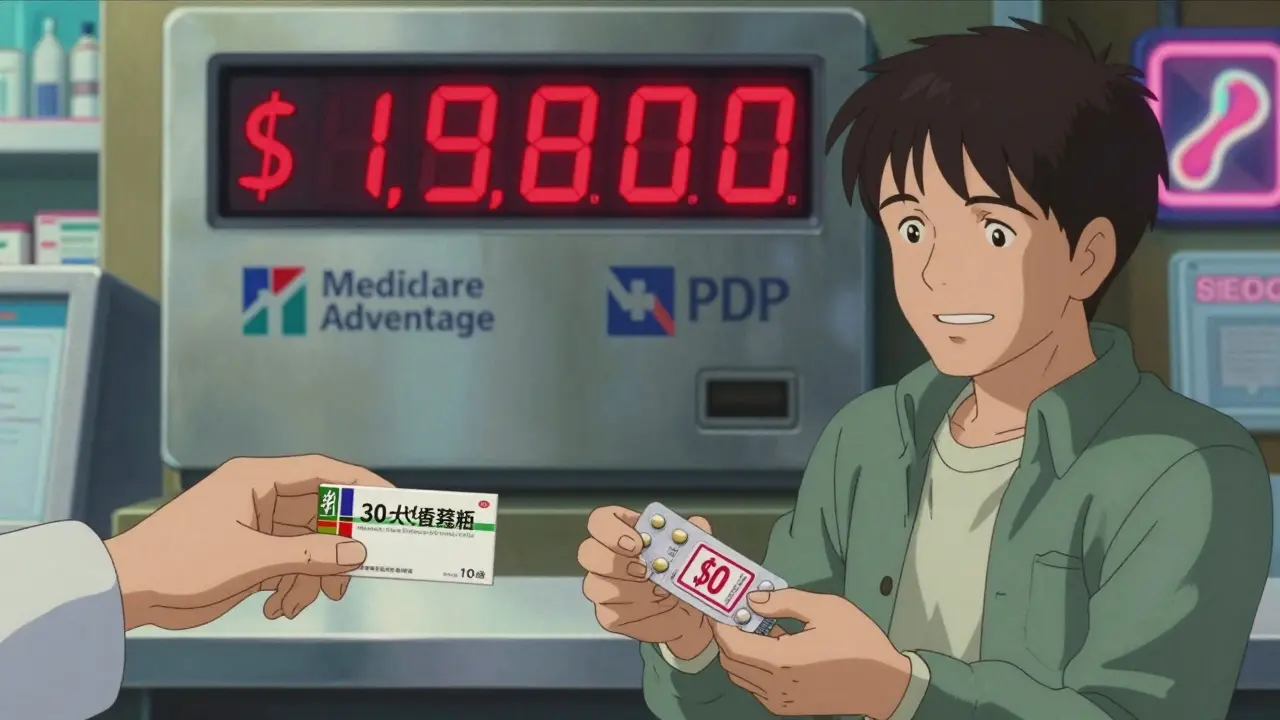

The biggest shift? The out-of-pocket cap dropped from nearly $8,000 to just $2,000. Before 2025, if you took multiple generics every month, you could spend thousands before hitting catastrophic coverage. Now, once you’ve paid $2,000 in eligible costs-deductibles, copays, coinsurance-you pay nothing for the rest of the year. That includes all your generic prescriptions. For someone on blood pressure or diabetes meds, that means a $1,200 annual bill could drop to $0 after hitting the cap.

This change didn’t happen by accident. The Inflation Reduction Act of 2022 forced Medicare to redesign how it pays for drugs. Now, plans have to absorb more of the cost after you hit the $2,000 cap. That’s why your copay for a 30-day supply of a preferred generic is often just $10-or even $0-if you’re past the cap. And if you qualify for Extra Help (Low-Income Subsidy), your copays are already $0 to $4.50, with no deductible at all.

How Much Do Generics Actually Cost Under Part D?

Generics make up 84% of all prescriptions filled under Part D, but only 27% of total spending. That’s because they’re cheap. In 2025, the median copay for a preferred generic is $10 for a 30-day supply. For non-preferred generics, it might be $20 to $30. But here’s the catch: not all plans treat generics the same.

If you’re in a stand-alone Prescription Drug Plan (PDP), you’re likely paying a monthly premium of around $39. But if you’re in a Medicare Advantage Prescription Drug plan (MA-PD), your drug coverage premium averages just $7. That’s a huge difference. And while the copays for generics are similar across both types of plans, the total cost of ownership is far lower with MA-PDs.

Also, remember: your monthly premium doesn’t count toward your $2,000 cap. Only what you pay at the pharmacy-deductibles, copays, coinsurance-counts. So if you’re paying $40 a month in premiums but only $5 a pill for your meds, you’re still working toward that cap. Once you hit it, your next 12 months of generics are free.

Why Some People Still Pay More Than They Should

Not everyone benefits equally. A 2024 survey found that 41% of beneficiaries didn’t understand how manufacturer discounts count toward the $2,000 cap. Some think their copay is $10, but if the drugmaker gives a $5 discount, that $5 still counts toward your cap. That’s good for you-but confusing if you don’t know it.

Another issue? Therapeutic substitution. Your plan might swap one generic version of your blood pressure pill for another-even if the new one has a higher copay. You might not notice until your next prescription is $15 instead of $5. About 27% of Part D plans use step therapy for at least 15 generic drug classes, meaning you have to try a cheaper alternative first.

And while generics are widely covered, some plans still require prior authorization-even for common ones. The Accessible Medicines Foundation found Part D plans put more restrictions on generics than commercial insurers. That means delays, paperwork, and frustration.

PDPs vs. MA-PDs: Which One Saves You More?

| Feature | Stand-Alone PDP | Medicare Advantage (MA-PD) |

|---|---|---|

| Average Monthly Premium | $39 | $7 |

| Median Generic Copay (30-day) | $10 | $10 |

| Annual Deductible (2025) | $590 (common) | $590 (common) |

| Out-of-Pocket Cap | $2,000 | $2,000 |

| Catastrophic Coverage After Cap | $0 copay | $0 copay |

| Extra Help Eligibility | Yes | Yes |

Bottom line: MA-PDs win on total cost. You get the same drug coverage, same cap, same $0 copay after $2,000-but with a much lower monthly fee. Most people don’t realize their Part D coverage is bundled into their Advantage plan. If you’re paying $39 a month for a PDP and your Advantage plan offers the same generics at $7, you’re leaving $384 a year on the table.

Who Saves the Most?

If you take two or more generic medications every month, you’re in the sweet spot. The average beneficiary taking generics will save about $400 a year under the new rules. For those on high-volume regimens-like someone on a statin, blood thinner, and diabetes pill-the savings can be $800 or more.

People on Extra Help save even more. Their copays are capped at $4.50 for generics, no deductible, and no coverage gap. That’s the most secure option if you’re on a fixed income.

But here’s the hidden truth: if you only take one generic a month, you might never hit the $2,000 cap. That means you’ll pay coinsurance (25%) all year. So if your pill costs $40, you pay $10 per fill. That’s still better than pre-2025, but you won’t see the big savings until you’re taking more.

What You Need to Do Now

Don’t wait until next year. Here’s what to do before December 31:

- Use the Medicare Plan Finder tool. Type in your exact medications-brand and generic names. Filter for plans with the lowest copays for your drugs.

- Check if you qualify for Extra Help. If your income is below $21,870 (individual) or $29,580 (couple), you’re likely eligible. Apply through Social Security.

- Ask your pharmacist: “Is this the preferred generic?” If not, ask if there’s a cheaper alternative on your plan’s formulary.

- Review your plan’s step therapy rules. If you’re being forced to try a different generic, call your plan and ask for a formulary exception.

- Track your out-of-pocket spending. Keep receipts. Once you hit $2,000, call your plan to confirm you’ve reached catastrophic coverage. Some people miss the $0 copay because they don’t know they’ve crossed the line.

What’s Coming Next?

In 2026, a new subsidy program will help plans cover high-cost generics, which could bring down copays even further. Biosimilars-generic versions of complex biologic drugs-are also gaining traction. While not traditional generics, they’re part of the same cost-saving trend.

But the biggest risk? Plans might start limiting access to the most expensive generics to avoid financial loss. That’s why it’s critical to monitor your formulary changes every year. Your plan might drop your generic and replace it with one you’ve never heard of.

The system isn’t perfect. But it’s better. In 2025, if you’re on generics, you’re getting the best deal Medicare has ever offered. The question isn’t whether you’ll save money-it’s whether you’re taking full advantage of it.

Do generic drugs work as well as brand-name drugs under Medicare Part D?

Yes. By law, generic drugs must contain the same active ingredients, strength, dosage form, and route of administration as their brand-name counterparts. They’re tested to be bioequivalent, meaning they work the same way in your body. The only differences are inactive ingredients, packaging, and price. Medicare Part D plans cover generics because they’re proven to be just as effective-and far cheaper.

Does my monthly premium count toward the $2,000 out-of-pocket cap?

No. Only what you pay at the pharmacy counts: your deductible, copayments, and coinsurance. Monthly premiums don’t count toward your $2,000 cap. That means you could pay $400 in premiums and still be far from reaching catastrophic coverage. Focus on your out-of-pocket drug costs, not your premium.

What if my plan switches my generic to a different one with a higher copay?

This is called therapeutic substitution. Your plan can legally switch your generic to another version-even if it costs more-unless your doctor says it’s medically necessary to stay on the original. You can request a formulary exception by asking your doctor to submit a letter of medical necessity. If approved, your plan must cover your original generic at the lower copay.

How do I know if I’ve reached the $2,000 out-of-pocket cap?

Your plan sends you an annual statement showing your total out-of-pocket spending. You can also call your plan’s member services and ask for your current TrOOP (True Out-of-Pocket) total. Once you hit $2,000, your copays for all covered drugs should drop to $0. If they don’t, call your plan immediately-this is a common error.

Can I switch Part D plans mid-year if I’m not happy with my generic coverage?

Normally, you can only change plans during the Annual Enrollment Period (October 15-December 7). But there are exceptions. If your plan removes a drug you need, changes its tier, or increases your copay significantly, you may qualify for a Special Enrollment Period. You can also switch if you qualify for Extra Help or move out of your plan’s service area.

Are all generic drugs covered under Part D?

No. Each Part D plan has its own formulary-a list of covered drugs. But plans must cover at least two drugs in each therapeutic category, including generics. If your generic isn’t covered, ask if there’s a similar one that is. If not, you can request a formulary exception. Most plans approve these if your doctor explains why you need that specific medication.

Final Thought: Don’t Guess-Check

Medicare Part D in 2025 is designed to protect you from drug costs. But it won’t protect you if you don’t know how it works. The $2,000 cap is real. The $0 copay after that is real. The savings are real. But you have to be the one to track your spending, compare plans, and ask questions. Your next prescription shouldn’t cost you more than it has to. Make sure it doesn’t.

Josh Potter

December 17, 2025 AT 02:20Bro this is straight-up life-changing. I was paying $80 a month for my blood pressure med last year. Now? $0 after I hit $2k. I didn’t even know I was eligible until I read this. My pharmacist didn’t tell me shit. Thanks for the wake-up call.

Evelyn Vélez Mejía

December 18, 2025 AT 10:40The structural recalibration of pharmaceutical cost allocation under the Inflation Reduction Act represents not merely fiscal policy, but a moral reclamation of dignity for the aging populace. The $2,000 cap is not a subsidy-it is a restitution. To treat pharmacological necessity as a commodity was an affront to human dignity; to cap it at two grand is the bare minimum of justice.

Victoria Rogers

December 19, 2025 AT 17:46Wait so now the government’s paying for my meds? Who’s footing the bill? My taxes? I’m tired of rich people getting free drugs while I’m still paying for my own. This is socialism and I’m not buying it.

Jane Wei

December 20, 2025 AT 16:52just started taking metformin last year and my copay went from $35 to $5. no joke i cried in the pharmacy. i didn’t even know i could get help. if you’re on meds and not checking your plan, you’re leaving money on the table. seriously.

Nishant Desae

December 21, 2025 AT 06:48As someone who lives in a small town in India and watches my sister in Ohio struggle with her insulin costs, I want to say this is beautiful. Even if you’re not American, this matters. When a country decides that a diabetic shouldn’t have to choose between food and medicine, that’s progress. I hope other nations follow. We need more of this kind of compassion, not less. And if you’re reading this and you’re on Medicare-please, please check your plan. You might be surprised.

Meghan O'Shaughnessy

December 21, 2025 AT 08:02My abuela switched from PDP to MA-PD last year and saved $400 just on premiums alone. She didn’t even know the difference until I sat down with her and showed her the Medicare Plan Finder. Now she’s got her statin for $3 and her blood thinner for free after April. She calls it her ‘Medicare miracle.’

Kaylee Esdale

December 22, 2025 AT 09:19if you take one pill a month you’re not gonna hit the cap so dont get excited. but if you take three or more you’re basically getting them free after a few months. check your meds. check your plan. do it now.

Jody Patrick

December 22, 2025 AT 09:58Medicare Part D is a scam. The cap is a gimmick. They’ll raise premiums next year and cut your formulary. You think $0 copay is permanent? Wake up.

Radhika M

December 23, 2025 AT 05:08My mom is on three generics. She hit the cap in July. Now she gets all her meds for free. She didn’t even know how to check her TrOOP. I helped her call the plan. It took 10 minutes. She’s saving $600 a year. This is simple. You just need to ask.

Philippa Skiadopoulou

December 24, 2025 AT 23:20The reduction in out-of-pocket expenditure for generic pharmaceuticals under the revised Part D framework represents a significant advancement in equitable healthcare access. However, the exclusion of premiums from the TrOOP calculation remains a structural anomaly that may inadvertently penalize low-income beneficiaries who rely on higher-premium plans for broader formulary access.

Pawan Chaudhary

December 26, 2025 AT 01:12hey everyone if you’re on meds and you’re not using the plan finder you’re doing yourself dirty. i helped my cousin switch plans and he saved $500. it’s not hard. just type in your drugs and click. i swear it took me 5 minutes. you got this.

Jonathan Morris

December 26, 2025 AT 15:39This is all a trap. The government knows most seniors won’t track their spending. They’ll hit $1,900 and think they’re safe. Then in January, they quietly remove your generic from the formulary and replace it with a $100 brand-name drug that’s ‘clinically equivalent.’ You’ll pay $50 a pill. Then they’ll say ‘you didn’t hit the cap because you’re not on a covered drug.’ This is how they control you.

Marie Mee

December 27, 2025 AT 21:16i think they're putting tracking chips in the pills now. why else would they care if i pay $0? they know everything. my last script came with a receipt that had my social security number on it. i'm not taking anymore. i'm going to the border for my meds now

Naomi Lopez

December 29, 2025 AT 10:04It’s amusing how the average American conflates affordability with virtue. The real story isn’t the $2,000 cap-it’s the fact that we’ve been overpaying for generics for decades because we didn’t demand transparency. This isn’t generosity. It’s capitalism finally catching up to its own inefficiencies.